The Transportation Security Administration (TSA) has granted additional funding to Liberty Defense to incorporate additional design efficiencies into the development of a High-Definition Advanced Imaging Technology (HD-AIT) upgrade kit for testing on an Advanced Imaging Technology (AIT) passenger screening system.

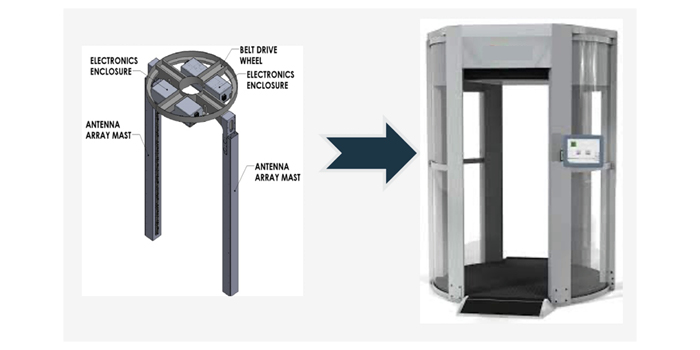

The HD-AIT next-generation people screening technology platform for threat detection uses high-definition imaging and artificial intelligence. The HD-AIT upgrade kit being developed is designed to enhance the capabilities of an existing AIT unit using open architecture, enabling the use of third-party hardware and software components. The TSA’s open architecture approach for software and hardware uses widely accepted standards to ensure interoperability across tools and platforms regardless of the technology designer, manufacturer or supplier.

“We continue to work closely with TSA on this critical initiative to help develop the next generation of passenger screening,” said Liberty CEO Bill Frain. “The upgrade kit will provide future state capability at the checkpoint, with the focus on detecting more threats and providing an overall better experience for the traveling public.”

Liberty licensed the HD-AIT body scanner and shoe screener technologies in March 2021. Both technologies were developed by researchers at the Pacific Northwest National Laboratory and funded by the Department of Homeland Security’s Science and Technology Directorate on behalf of TSA. Liberty is now developing the technology in house with its experienced team of engineers.

Liberty Defense has also announced that pursuant to the company’s omnibus long-term incentive plan, and subject to regulatory approval, it has granted a total of 75,000 stock options (options) and 1,590,975 restricted share units (RSUs) to certain directors and officers of the company, effective October 16, 2023. Each Option is exercisable for one common share in the capital of the company at an exercise price of US$0.19 per share. 12.5% of the options will vest on January 16, 2024, and an additional 12.5% will vest every three months thereafter. The options will expire on October 16, 2028. All 1,590,975 RSUs will vest on October 16, 2024. All options and RSUs are subject to the terms of the company’s omnibus long-term incentive plan and applicable securities law hold periods.

For more on security, please click here.