Ontario International Airport (ONT) in San Bernardino County, California, has agreed to lease 80ha of surplus property to real-estate company CanAm Ontario for 55 years, with the expectation that the area will generate approximately US$275m over the first 10 years.

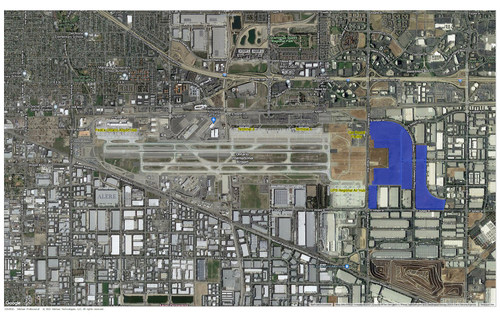

The property, east of Haven Avenue, north of Jurupa Avenue, south of Airport Drive and west of Carnegie Avenue, was deemed unsuitable for typical airport use by the airport’s managing committee, the Ontario International Airport Authority (OIAA).

The deal calls for a non-refundable US$10m deposit to OIAA. After giving time for CanAm Ontario to obtain local jurisdictional entitlement and environmental approvals, rental revenue to the OIAA will start at US$25m in the first year, increasing in five-year increments, resulting in revenue of US$90.6m per year in the final five years. The net present value of the agreement is US$625m. This lease is intended to support ongoing airport improvements while keeping costs down for airlines.

CanAm Ontario was selected out of 17 bidders to lease and develop the vacant property for industrial use in compliance with the Airport Compatibility Plan required under state law. Airport officials noted that special consideration was given to ensure the transaction complies with applicable federal laws and FAA policies and provides lease revenue exceeding fair market value as determined by three independent appraisals. Federal law requires that revenues generated by the airport be used for airport purposes.

Alan Wapner, mayor pro tem of the City of Ontario and president of the OIAA board of commissioners, said, “We are pleased and proud to move forward with the first of several major real-estate transactions to monetize vacant property since the airport was transferred to local control in November 2016. As envisioned in the OIAA strategic business plan, the ongoing revenue stream will help ONT fund vital safety, security and infrastructure projects while keeping airport costs to airlines low. As a result, ONT will become even more attractive for airlines to inaugurate and increase flight schedules.”

Steven Ames, managing director, investments, at USAA Real Estate, commented, “USAA is excited to enter into another large-scale industrial project in the Inland Empire [in southern California] with McDonald Property Group. Given our long track record of success with McDonald, it is our vision that the Ontario International Airport project will continue in that tradition and become one of the most prominent industrial/logistics developments in the region.”

Trey Hettinger, chair of the ONT Airline Affairs Committee representing the signatory passenger and cargo airlines operating at ONT, said, “The air carriers at Ontario support efforts that keep operating costs low, which benefits anyone who uses the airport. This is an example of the Authority’s continued efforts to provide funding for airport improvements while reducing airline costs.”