Market intelligence firm Interact Analysis has published a new report on the airport logistics automation market containing an analysis of baggage, cargo and software in airports globally.

The report shows that while global passenger traffic in 2020 fell 61% compared with the previous year, this did not cause a corresponding fall in airport logistics automation revenues.

One reason for this was that equipment installations are based on predicted demand for several years ahead, not just the current year. Despite this, 2021 airport logistics automation revenues are forecast to remain at the 2020 level due to continued uncertainty around available finance and the impact of reduced confidence, both fueled by the pandemic.

Conversely, the cargo sector did relatively better in 2020: cargo traffic increased while automation sales for cargo remained stable. Furthermore, automation equipment sales for the cargo sector in 2021 are projected to be higher than in 2019.

According to the report, the pandemic has led to a reduction in greenfield airport projects, limiting overall automation revenue growth in 2020. However, China is forecast to experience substantial growth with an average year-on-year rate of 7.2% from 2020 to 2025. The US and European airport logistics automation markets are deemed as ‘mature’, with the US market responsible for 22% of revenue in 2021, Europe at 26% and China at 15%.

Interact Analysis has found that demand for technologies relating to airport automation have gained momentum over the past year, with revenues for self-bag drop systems expected to grow from US$62m in 2020 to US$145m in 2025. Individual carrier systems (ICS) have been shown to have good market penetration, holding a 21% share of baggage handling system (BHS) revenue in 2021. This is expected to increase to 22% by 2025.

The four top suppliers within the USA and Europe (Vanderlande, Siemens, Beumer and Daifuku) share 90% of the market. However, the Chinese market looks very different: Siemens and Vanderlande still compete strongly, but the local base of suppliers led by CALTCO generates the majority of revenue in China.

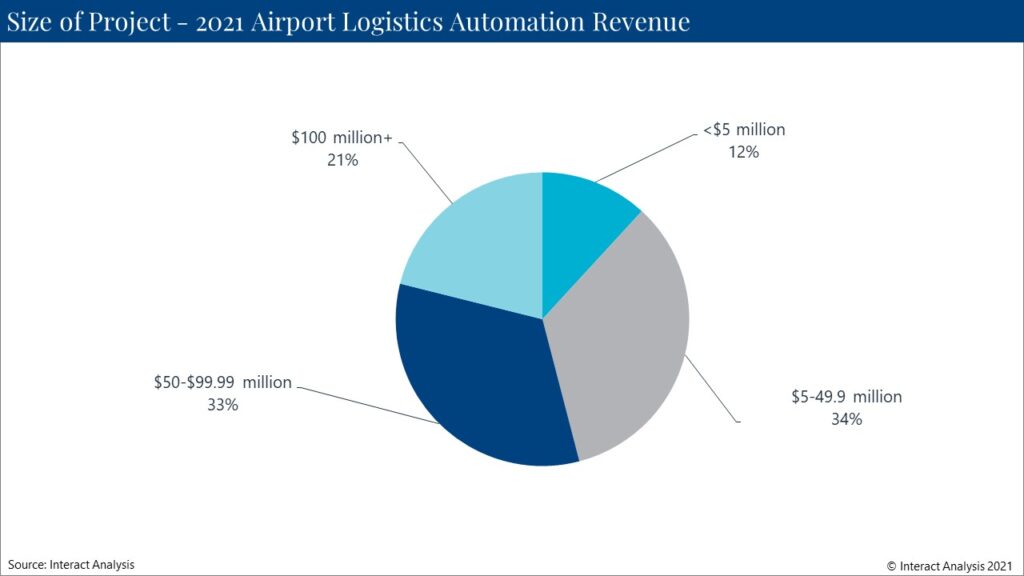

Jamie Fox, principal analyst at Interact Analysis, said, “One particularly interesting finding is that mid-sized projects will be key to the airport logistics automation business. The majority of 2021 revenue will be generated from projects of between US$5m and US$100m. Capacity expansion and equipment upgrades will also be important in the recovery.”